Yes – casual employees still need to be on payroll in New Zealand. If someone is your employee, you must deduct PAYE, make the right deductions, and report their income to Inland Revenue. This guide explains what “on payroll” really means and what you need to do as an employer.

Inland Revenue has a dedicated section for employers at ird.govt.nz/roles/employers , which is worth bookmarking.

What Does “On Payroll” Mean?

Putting someone “on payroll” simply means you treat them as an employee for tax and reporting purposes. That includes:

- Registering as an employer with Inland Revenue (if you have not already)

- Deducting PAYE tax from their wages

- Making any other required deductions (KiwiSaver, student loans, child support)

- Filing payday reports to Inland Revenue

Inland Revenue’s Employer’s guide (IR335) explains these responsibilities in more detail.

Casual Employees Are Still Employees

Even though a casual employee may only work occasionally, they are still an employee under New Zealand law. Employment New Zealand’s casual employment guidance makes it clear that casual staff:

- Are entitled to minimum employment rights

- Must be paid at least the minimum wage

- Have rights such as breaks and a safe workplace

Because they are employees (not contractors), their pay needs to go through your payroll system with the correct deductions.

Registering as an Employer With Inland Revenue

If you are a sole trader or business hiring your first employee, you need to register as an employer with Inland Revenue before you pay wages.

You can do this online through myIR. Inland Revenue’s page Register as an employer explains the steps. In summary:

- Log in to myIR

- Go to “I want to…”

- Select “Register for new tax accounts”

- Choose “Employer” and complete the required details

Information You Must Collect From Casual Employees

Before you pay a new casual employee, make sure you have:

- Their full legal name and contact details

- Their IRD number

- A completed IR330 tax code declaration

- Details of any student loan obligations

- Their bank account number for wage payments

- Their KiwiSaver status (whether they are already a member)

Inland Revenue provides the IR330 and other forms on its forms and guides section.

Payroll Obligations for Casual Employees

Once a casual employee is on your payroll, you must:

- Calculate PAYE using the correct tax code

- Deduct KiwiSaver contributions if applicable

- Deduct student loan repayments if required

- Calculate ACC earner levy as part of PAYE

- Include 8% holiday pay if you are paying pay-as-you-go

- Provide a payslip showing all these items clearly

Inland Revenue has online tools and calculators at ird.govt.nz/calculators-and-tools which can help with PAYE calculations.

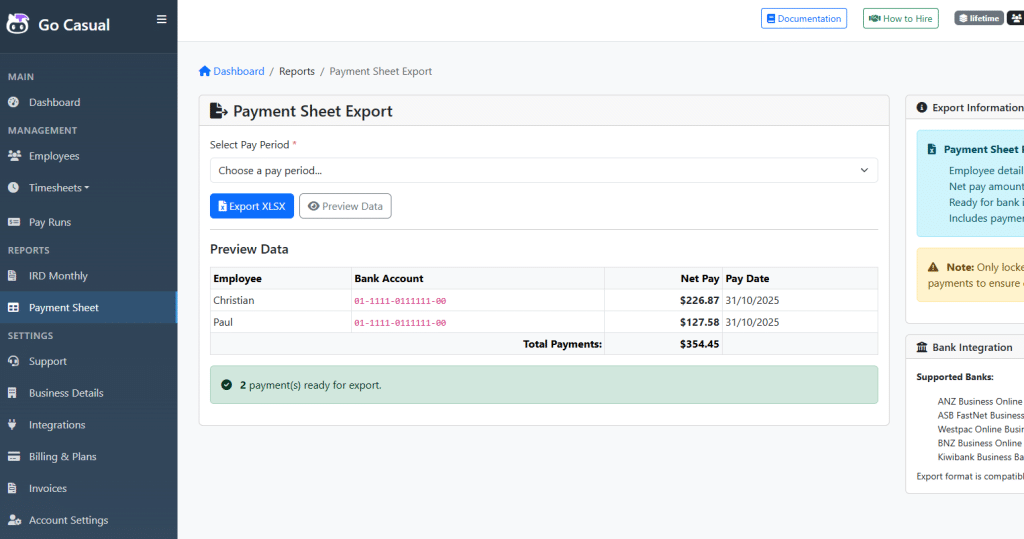

Payday Filing and Reporting

New Zealand uses payday filing. This means you must report employment information to Inland Revenue each time you pay your employees, rather than once a month.

You can read more about payday filing on Inland Revenue’s website: Payday filing for employers .

For casual staff, you follow the same process as any other employee – report their earnings and deductions for each payday.

Employee or Contractor? Getting It Right

Some employers are tempted to treat casual staff as contractors to avoid PAYE and payroll obligations. This can be risky.

Employment New Zealand has a guide on employee vs contractor . Factors such as control, integration into your business, and how the work is performed all affect status.

Summary: Casual Workers Must Be On Payroll

If you hire someone as a casual employee, you still need to: